You’ve probably heard of workers compensation — or workers comp — before. These laws are designed to ensure employees injured on the job get the financial support they need while reducing your liability as their employer.

Workers compensation insurance goes hand in hand with these laws. This guide answers some of the most common questions about workers comp coverage for food and beverage businesses to give you the information you need to support your employees, meet legal requirements, and safeguard your business from claims!

What Is Workers Compensation Insurance and What Does It Cover?

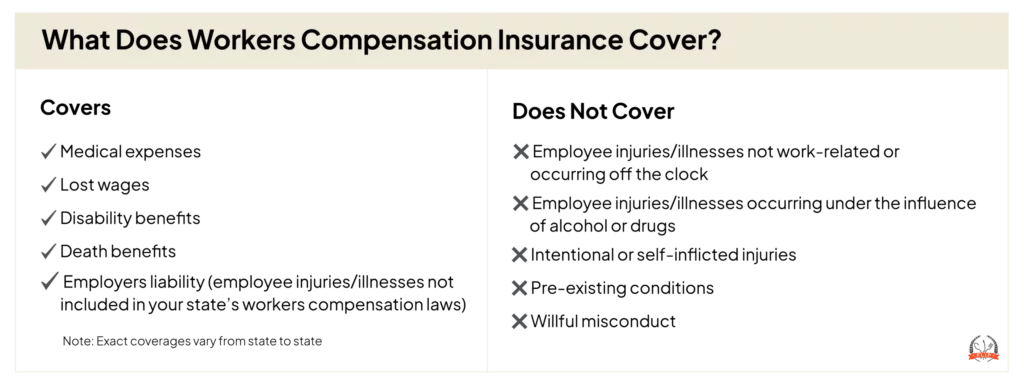

Workers compensation insurance covers the cost of state-required benefits for your employees’ work-related injuries, accidents, and illnesses.

It’s important to note that work-related illnesses don’t refer to someone catching a cold while on the job. Instead, they are the direct result of the employee’s work duties, like developing asthma after constant exposure to flour dust.

While exact benefits vary between states, the following expenses are typically covered:

- Medical bills

- Lost wages

- Disability benefits

- Death benefits (e.g., funeral costs)

- Employers liability (more on this later)

Workers comp doesn’t just ensure your employees get the financial support they need to rehabilitate and re-enter the workforce after an incident. It also protects you and your business from the potentially catastrophic cost of these claims.

Part One: Workers Compensation

This part of the policy is exactly what it sounds like: it covers the cost of workers compensation benefits your state requires you to pay after a claim. You may also see it referred to as Coverage A.

Because each state has its own laws regarding benefits, this part of the policy doesn’t have standard coverage limits like other types of insurance. Instead, the limit is determined by your state.

Part Two: Employers Liability

Food Liability Insurance Program’s (FLIP) workers compensation policy also includes a section called Employers Liability, or Coverage B. This part of the policy protects you if an injured or ill employee sues you for negligence.

Generally, your employees give up their right to sue you for negligence by accepting workers compensation benefits. However, some states have given this right back to workers in specific situations, such as suing for damages that aren’t covered by your state’s benefits.

That’s why having a policy that includes both Part One: Workers Compensation and Part Two: Employers Liability is crucial. Part Two is designed to protect you financially if your employee decides to sue you, covering costs like:

- Attorney’s fees

- Settlements

- Judgments

Who Needs Workers Compensation Insurance?

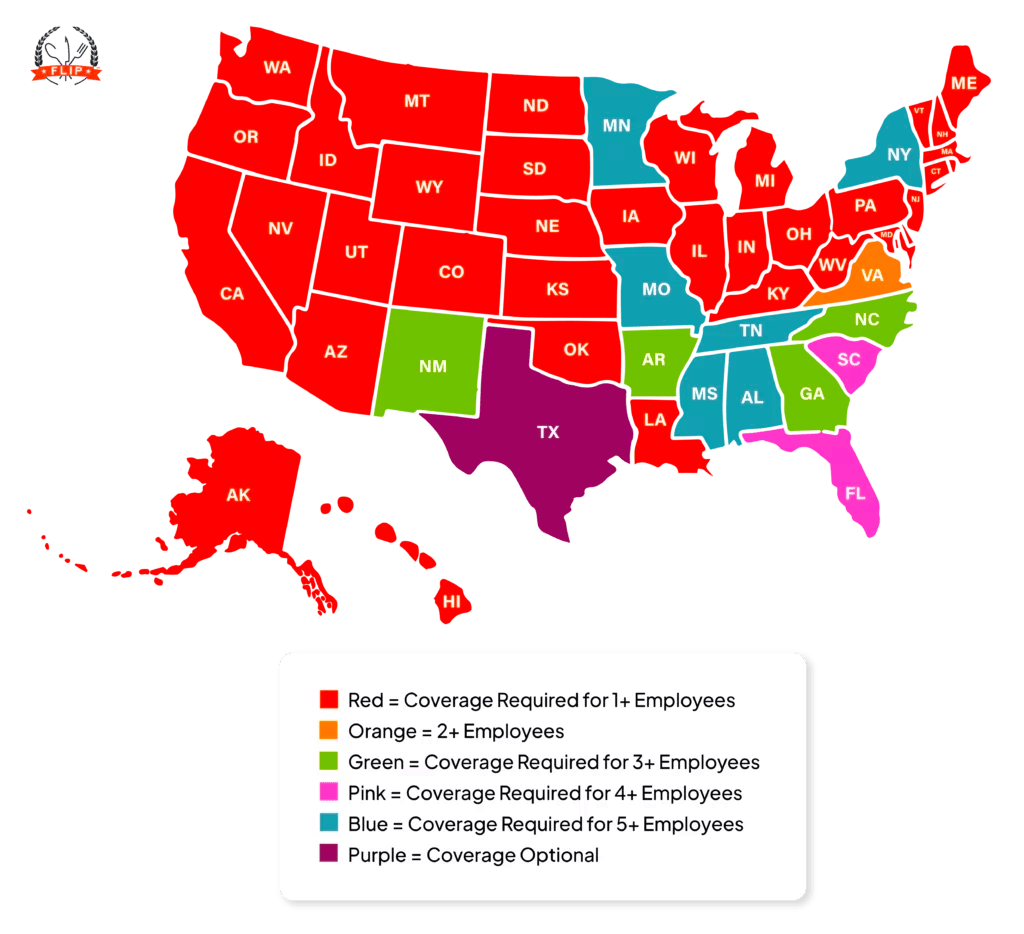

In most states, if you have one or more employees, workers compensation coverage is mandatory. Texas is the only state that does not require employers to get this insurance at all. However, it’s still highly recommended to protect yourself against the cost of employee injuries and lost wages.

Workers compensation claims can be extremely expensive, costing tens of thousands of dollars. From 2021–2022, the National Council on Compensation Insurance (NCCI) found the average workers compensation claim was $44,179.

Most businesses cannot afford a claim like this, which is why most states require insurance. If your employee needs to receive workers compensation benefits, the policy is designed to cover those costs so you don’t have to.

See more workers compensation stats that prove why insurance is critical for your business.

Monopolistic vs. Competitive States

Most states are considered competitive states, meaning you can buy workers compensation coverage from a state fund or a private insurance company like FLIP.

However, there are four states that only allow you to buy this coverage through a state fund. These monopolistic states are:

- North Dakota

- Ohio

- Washington

- Wyoming

If you live in a monopolistic state, you can’t get workers compensation insurance from FLIP or any other private insurer. Monopolistic state funds typically only include workers compensation coverage, so you may need to buy a separate employers liability policy if you want that protection.

Minimum Employee Requirements by State

Exemptions

In some instances, you are exempt from providing coverage for your workers. These exemptions tend to fall into two categories: the type of workers you hire and the number of workers you have.

Type of Workers

Workers compensation typically only covers full- or part-time employees. This may not include:

- Independent contractors

- Freelance workers

- Volunteers

Every state is different, so some states do require you to carry insurance if your workers fall into these categories. For example, Louisiana’s laws require employers to cover independent contractors if their job duties include considerable manual labor.

Number of Workers

While many states require you to have workers compensation insurance as soon as you hire your first employee, the threshold is slightly higher in others. In Alabama, for instance, if you have fewer than five employees, you are not required to purchase coverage.

What Factors Affect the Cost of Workers Compensation Insurance?

FLIP uses several factors to determine your workers compensation premium, including:

- What state(s) your employees work in

- How many employees you have

- Your annual payroll

- Your industry (some lines of work are riskier than others)

- What type of work your employees do (more dangerous work = higher premiums)

- If you’ve ever had a workers compensation claim before

These factors cause the cost of workers comp to vary widely from one business to the next. However, most small businesses pay an average of $542 per year.

How Do I File a Workers Compensation Claim?

Follow these steps to properly file your claim with FLIP if an employee reports an injury or work-related illness:

- Encourage your employee to seek immediate medical attention if they haven’t already.

- Provide your employee with the paperwork they need to fill out information about the injury or illness, including when it happened or when they first noticed it. You can download these forms from your state’s official website.

- Speak with any witnesses who saw the accident occur and document their comments.

- Log in to your FLIP user dashboard and go to “File a Claim.” Fill out the required information and include any supporting documents before submitting.

- Fill out and submit a first report of injury form to your state’s workers compensation board, if they require it.

Why Get Workers Compensation Insurance From FLIP?

We make it easier than ever for food and beverage businesses to get workers compensation coverage with our 100% online application. In fact, it takes most people just 10 minutes to complete!

Choose between several different payment options:

- Annual

- Quarterly

- Semiannual

- Monthly (for policies exceeding $1,000 per year)

Whether you already have a policy with us or not, you can get workers compensation and general liability coverage in one convenient place.

FAQs About Workers Compensation Insurance

Am I Required to Have Workers Compensation Insurance if My Employees Are My Family Members?

Yes! Family members are not exempt from workers compensation benefits, so you still need to carry insurance to cover those expenses if they have a work-related injury or illness.

Does Workers Compensation Insurance Cover the Delivery Drivers I Hire?

Do I Need a Workers Compensation Policy if I Don’t Have Any Employees?

How Is Workers Compensation Insurance Different From Disability Insurance?

There are two major differences between workers compensation and disability coverage:

- Health and disability insurance only apply to non-work-related injuries, while workers compensation insurance only covers work-related injuries.

- Many businesses are required to carry workers compensation coverage for their employees, but not disability insurance. You might choose to cover the cost of your employees’ disability insurance as one of their benefits, but you aren’t required to. Instead, your employees make a tax-deductible contribution to this program if they want coverage.

Alex Hastings

Seattle-based copywriter and (WA) licensed insurance agent Alex Hastings leverages her experience as a lover of fast-casual food, baked goods, and iced oat milk lattes. She holds a B.A. in Creative Writing from Western Washington University. Before working at Veracity, she was a retail copywriter at Zulily and an English language teacher in South Korea. Alex is fully trained on FLIP insurance coverages and writes content that connects food and beverage business owners with the policies they need.

Seattle-based copywriter and (WA) licensed insurance agent Alex Hastings leverages her experience as a lover of fast-casual food, baked goods, and iced oat milk lattes. She holds a B.A. in Creative Writing from Western Washington University. Before working at Veracity, she was a retail copywriter at Zulily and an English language teacher in South Korea. Alex is fully trained on FLIP insurance coverages and writes content that connects food and beverage business owners with the policies they need.

Kyle Jude

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.