Workers Compensation Insurance

Food Liability Insurance Program (FLIP) makes it easy to meet legal requirements and protect your business with our 100% online purchasing process.

What Is Workers Compensation Insurance?

Workers compensation insurance is a type of coverage that provides medical benefits and wage replacement to employees who suffer a work-related injury or illness.

All states (except Texas) require this coverage for businesses with employees, uninsured independent contractors, or volunteers.

Who Needs Workers Compensation Insurance?

If you run a food business with full- or part-time employees, contract workers, or even volunteers, you need workers compensation coverage.

FLIP’s workers compensation insurance is available for:

Who Is Excluded From Purchasing Workers Compensation Insurance Coverage From FLIP?

If you live in one of the following monopolistic states, you are not eligible to purchase this policy from FLIP because we are a private insurer:

- Ohio

- North Dakota

- Washington

- Wyoming

Monopolistic states do not allow employers to buy workers compensation insurance from private insurers. Instead, you must purchase coverage through the state’s monopolistic fund.

How Does Workers Compensation Insurance Work?

Your workers compensation policy is made up of two parts:

- Part One: Workers Compensation

- Part Two: Employers Liability

Part One: Workers Compensation

Part One requires your insurance company to pay the amount of compensation required by your state in the event of a claim. Unlike other types of insurance, workers compensation coverage does not have standard limits. Part One covers whatever you are legally obligated to pay because of the injury or illness.

Part Two: Employers Liability

Part Two is the coverage you — the employer — receive if an employee sues you over a work-related injury or illness that isn’t covered by your state’s workers compensation benefits. Unlike Part One, Part Two does have limits.

What Information Will I Need About My Business to Get a Quote?

We need some details about your business to give you a quote, including your:

- Business type

- Federal Employer Identification Number (FEIN)

- Address

- Phone number

Note: When filling out your application, you must select the business class (e.g., caterer, food truck, etc.) that best describes your business. Selecting the wrong business class can cause delays and lengthen the time it takes for you to get insured.

How Long Does It Take to Get Insured?

It takes most business owners about 10 minutes to get a workers compensation quote from FLIP. Having the above information at the ready when you start your application will speed up the process.

What Are Common Workers Compensation Claims?

Common work-related injury or illness claims for food and beverage business employees include:

- Slip-and-fall injuries on slippery kitchen floors

- Muscle strains or overexertion from lifting heavy bags of flour

- Burns from hot surfaces like stoves

- Cuts and lacerations from knives during food prep

- Accidents caused by operating or using business equipment, like ovens and induction ranges

- Third-party action-over

- Loss of consortium

What Does the Claims Process Look Like?

Each state has its own laws determining correct workers compensation claim procedures, but coverage typically follows this process:

- Your employee reports their work-related injury or illness to you, their employer

- You file a claim with FLIP

- Your employee receives appropriate financial compensation for medical care and wage replacement, as determined by your state laws

The goal of this coverage is to provide the monetary support needed to help your employee return to work as soon as possible. If they are unable to return to work, they may be able to receive long-term benefits depending on the laws in their state.

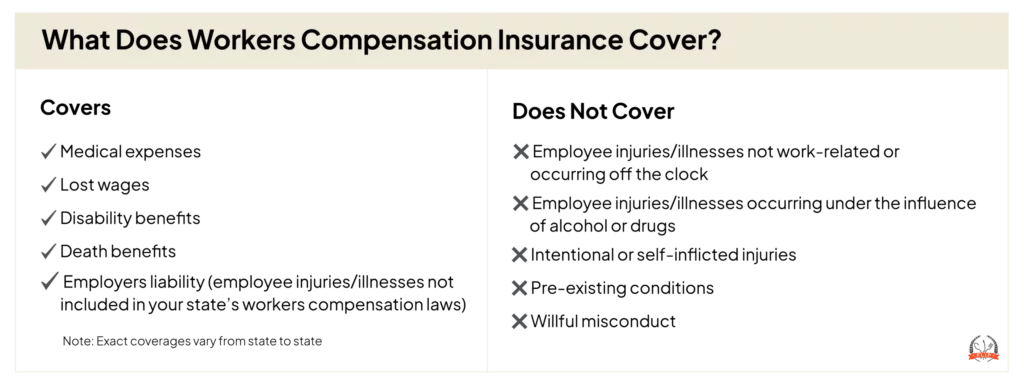

What Are the Limits to My Coverage?

Workers Compensation Insurance Coverage

Because workers compensation laws differ from state to state, your coverage limit depends on your state’s specific statutory requirements.

Employers’ Liability Coverage Limits

The maximum coverage for damages resulting from bodily injury by disease for any number of employees.

$1,000,000 Policy Limit

The maximum coverage for bodily injury to one or more employees in any one accident.

$1,000,000 Each Incident

The maximum coverage for damages resulting from bodily injury by disease for any number of employees.

$1,000,000 Each Employee

Why FLIP for the Best Workers Compensation Insurance?

Quick Application Process

Get a workers compensation insurance quote in about 10 minutes — roughly the time it takes to bake a dozen chocolate chip cookies.

100% Online Quote

Most companies make you speak with an agent to get a quote. With FLIP, you can get your free quote by filling out our online application.

Flexible Payment Options

FLIP makes it easy for you to pay your way. Choose between annual, quarterly, semiannual, and monthly* plans.

*Monthly payments are only available for policies exceeding $1,000 per year.

Hear From Real FLIP Customers

Yes. Part Two of FLIP’s workers compensation policy can protect you if your injured employee sues a third party for a work-related injury or illness that isn’t included in your state’s benefits if that third party attempts to hold you responsible.

For example, if one of your employees hurts themselves on an industrial stand mixer and sues the manufacturer, that manufacturer might try to hold you responsible instead. They might claim you were not using the equipment properly, so they shouldn’t be liable for the injury.

Yes. If the spouse of your injured employee sues you because that employee is no longer able to give them the companionship, support, or services they were able to prior to their injury or death, Part Two of your policy can cover those damages.

All states except Texas require employers to purchase this coverage. However, exact requirements and exemptions differ between states, so check workers’ compensation laws in your state to confirm what coverage you need.