Food Trailer Insurance Cost

How much is insurance for a food trailer — and how is that price determined? Get answers to the most common questions people have about food trailer insurance costs so you can purchase the perfect policy with confidence. Ranked best insurance for food trailers by Investopedia.

How Much Does Food Trailer Insurance Cost?

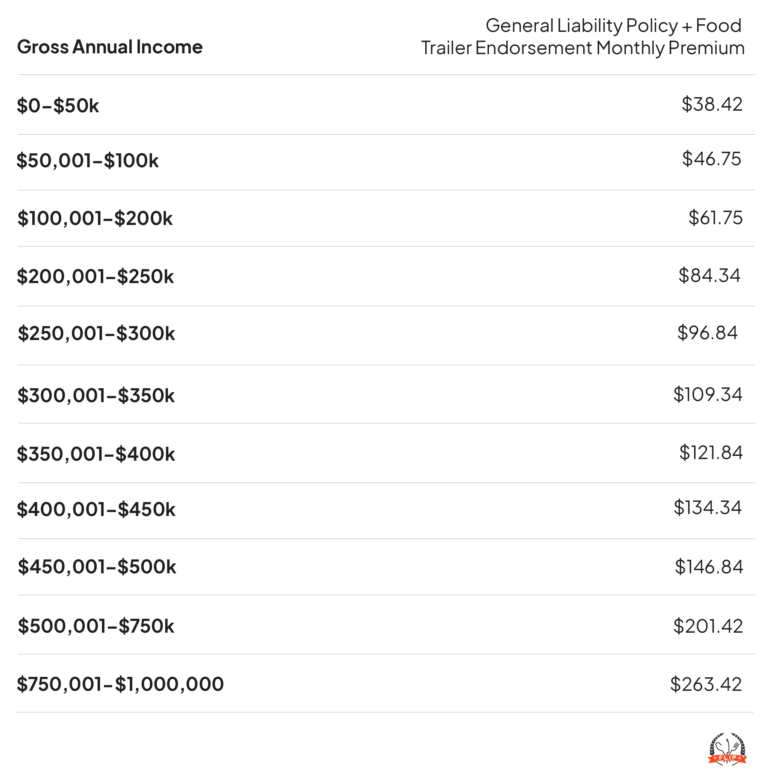

Food trailer insurance starts at $38.42 per month. This price includes our base general liability policy, which starts at $25.92 per month, plus our exclusive food trailer endorsement at $12.50 per month.

FLIP is proud to be the exclusive provider offering a food trailer endorsement, extending your general liability coverage to one of your most important assets.

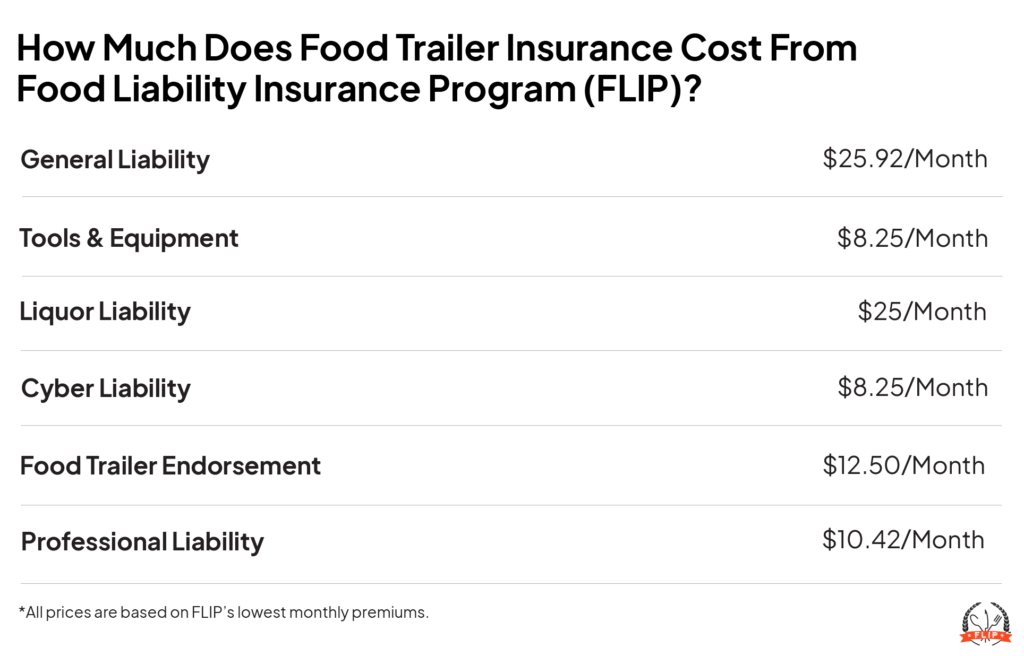

How Much Does Each Type of Coverage Cost?

What Factors Affect Food Trailer Insurance Cost?

The cost of your premium depends on a few key factors. One thing that impacts how much you pay for general liability insurance is the amount your business makes in a year.

The type of coverage you choose also affects how much your insurance will cost. For example, you can easily expand protection for your business with other policies and add-ons from FLIP, including:

- Inland Marine (Tools and Equipment)

- Liquor Liability Insurance

- Cyber Liability Insurance

- Workers Compensation Insurance

- Professional Liability Insurance

Adding optional coverages will increase how much you pay monthly or annually. But FLIP keeps these costs as low as possible so you can get a policy tailored to your exact needs at an affordable price.

Finally, a history of filing claims may increase your premium, because a business that has filed claims in the past may pose more of a financial risk than one that hasn’t. To keep things fair, a riskier business could face higher premiums.

Can I Reduce the Cost of My Insurance?

Even though you can’t reduce the starting cost of food trailer insurance, you can avoid higher rates by identifying risks and taking steps to prevent accidents from happening, such as:

- Following proper food handling and storage practices

- Having your business equipment regularly inspected and serviced to prevent breakdowns and malfunctions

- Keeping walkways and areas around your trailer clean and free of debris and tripping hazards

- Clearly marking menu items that contain common allergens with easy-to-read labels

Why FLIP for the Best Food Trailer Insurance?

Exclusive Provider of the Food Trailer Endorsement

Top-Rated Coverage

Customizable Policy

Free & Unlimited Additional Insureds

24/7 Online Access

Instant Certificate of Insurance

Coverage Details Limits

General Liability Aggregate Limit

$2,000,000

Products – Completed Operations Aggregate Limit

$2,000,000

Personal and Advertising Injury Limit

$1,000,000

General Each Occurrence Limit

$1,000,000

Damage to Premises Rented to You Limit (Any One Premises)

$300,000

Liability Deductible

NO DEDUCTIBLE

Inland Marine Limit (Any One Article / Aggregate)

$5,000/$10,000

Inland Marine Limit (Per Occurrence) – Deductible

$250

Medical Expense Limit

$5,000

How Do I Get a Quote?

2. Select your business activities

3. Fill out all required fields

4. Get your free quote and finish checking out!

FAQs About the Cost of Food Trailer Insurance

Does Food Trailer Insurance Cover Equipment and Inventory?

Tools and equipment coverage (aka inland marine) is not included in a base policy. But you can add it during checkout or from your online dashboard after buying a FLIP policy. Choose from two options:

- $5,000 per item / $10,000 per year ($8.25/mo.)

- $10,000 per item / $50,000 per year ($28.25/mo.)

Does Food Trailer Insurance Cover Both the Trailer and the Business Operations?

Yes, but only while your food trailer is parked and detached from your towing vehicle. Make sure you have a commercial auto policy* in place to cover your trailer when you’re on the road!

*FLIP does not offer commercial auto insurance at this time.

What Types of Coverage Are Included in Food Trailer Insurance?

Food trailer insurance includes both general and product liability as well as FLIP’s exclusive food trailer endorsement:

- General Liability for third-party bodily injury and property damage claims

- Product Liability for claims related to your food or beverage products

- FLIP’s Food Trailer Endorsement extends general liability coverage to your food trailer when it’s detached from your vehicle and parked at an event

Are There Any Specific Insurance Requirements for Operating a Food Trailer?

It’s very common for food trailer event and festival organizers to require proof of insurance with your vendor application and to be added to your policy as an additional insured. This protects them from your liability if you cause an accident due to your negligence or business operations.

FLIP makes it free and easy to add unlimited additional insureds anytime from the convenience of your online dashboard.

Can I Bundle Food Trailer Insurance With Other Business Insurance Policies?

Yes — if you sell, serve, or provide alcohol as part of your business, you can bundle liquor liability insurance with your food trailer policy starting at $453 per year. If you only need short-term liquor coverage, you can bundle your general liability policy with event liquor liability insurance starting at $150 per event.

Additionally, food trailer businesses are eligible for a workers compensation policy from FLIP, which you can purchase in addition to your base general liability coverage. This coverage is designed to protect you and your employees in the event one of them gets seriously injured or dies on the job.

Reviewed by: Kyle Jude

Kyle Jude is the Program Manager for Food Liability Insurance Program (FLIP). As a dedicated program manager with 10+ years of experience in the insurance industry, Kyle offers insight into different coverages for food and beverage business professionals who are looking to navigate business liability insurance.